Self-Serve Business Account Opening

Client

Canada Big 5 Bank

Role

UX Design Lead

Year

2023-2024

I led the design initiative for a self-serve business banking account opening platform. By simplifying intricate financial processes and optimizing the account opening journey, I created an intuitive experience tailored for small business owners. Through thorough user research and strategic interface design, the platform empowers users to open business banking accounts seamlessly, enhancing clarity and efficiency at every step.

It all started with “It can be very complex. How can we do it right?“

Based on our results of competitive analysis, user interviews, and expert consultations, our design objective for the business account open process is to strike a delicate balance between trust, simplicity, and security, ensuring a seamless and secure experience for our users.

-

Our competitive analysis focused on the online business bank account opening experience among mainstream Canadian banks. Key takeaways revealed significant gaps in the market: Firstly, most big banks lack the capability to enable immediate business account opening for new clients. Secondly, extensive business registration information is often required during the application process. Lastly, clients are confronted with dense terms and conditions text, posing challenges for informed consent.

-

Conducting user interview sessions with Canadian Small Business Owners provided invaluable insights into their preferences for online banking product applications. Key takeaways revealed a strong emphasis on simplicity, minimizing back-and-forth interactions, and fostering a sense of trust. These findings have guided our design approach to prioritize user-centricity and deliver a streamlined, trustworthy experience for our users.

-

Expert consultations with SMEs from privacy, legal, and anti-money laundering (AML) sectors further emphasized the critical importance of data accuracy, client data privacy, and anti-money laundering measures in business banking account opening. Integrating their insights, we fortified our design approach to prioritize security and compliance, ensuring a trusted and seamless experience for our users.

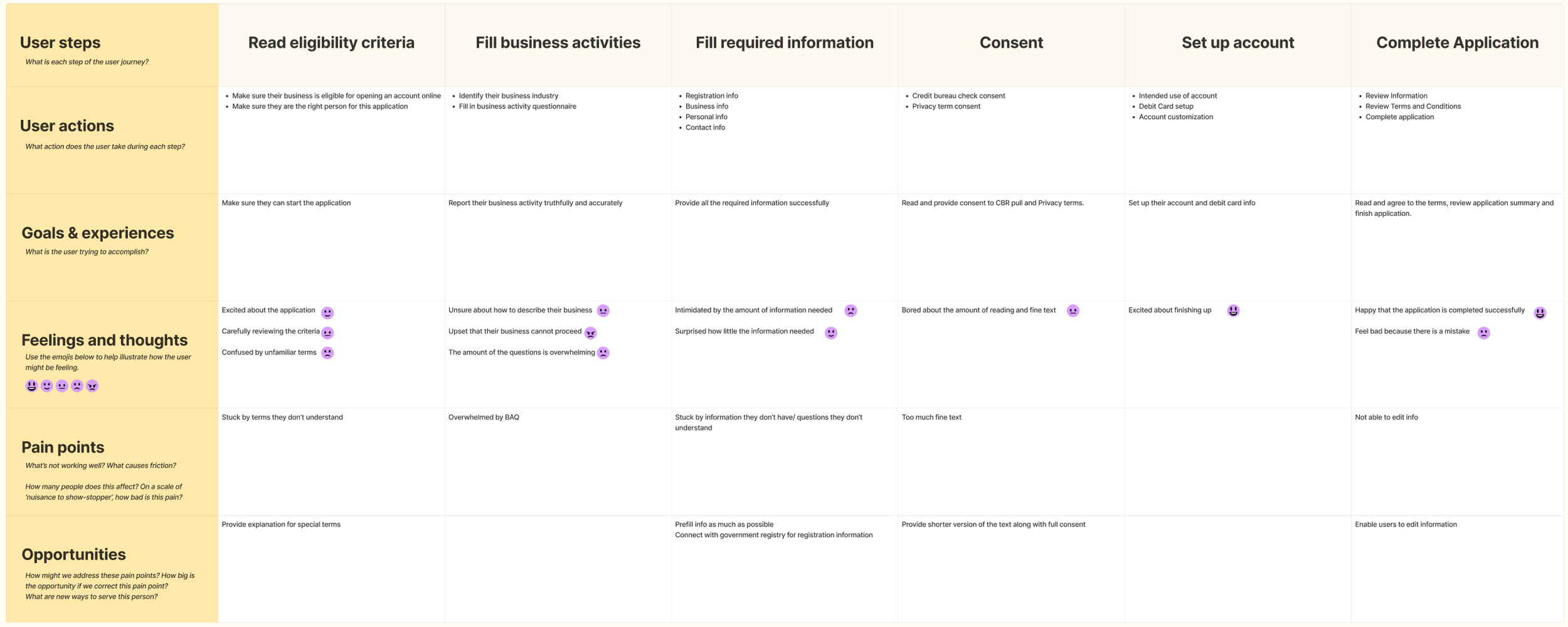

User Journey Mapping

By merging the business requirements with insights from user and industry research, I developed a user journey map to comprehensively grasp the process and key steps of the application flow. Subsequently, the user journey map underwent thorough review by product owners, digital product managers, and developers, leading to iterative refinements.

A few key opportunities were identified:

Explanatory content for banking terms

Simplify form filling process by leveraging APIs

Reduce the risk of cognitive overload

Main Objectives

Clear requirements and instructions

We need to inform the client about the criteria and requirements they need to prepare before the application process begins.

Set expectation about duration

The client should have clarity regarding the time required for this application process.

Predictability

The client should have clarity regarding what will happen next throughout the application.

Cognitive load awareness

Ensure that the information displayed on each screen is kept to a manageable level to prevent cognitive overload.

Understandability

Make sure that banking terms used in the application are clear, user-friendly, and easy to understand.

Scalability

In line with the bank's strategy, the platform must possess scalability and readiness for future enhancements, including opportunities for cross-selling.

Design highlights

Clear guidance

Our application streamlines the user experience by providing clients with clear guidance on what to prepare in advance. Through intuitive prompts and instructions, users are informed about the necessary documents and information required prior to starting the application process. By proactively addressing preparation needs, we aim to enhance efficiency and convenience for our clients, ensuring a smooth and seamless experience from start to finish.

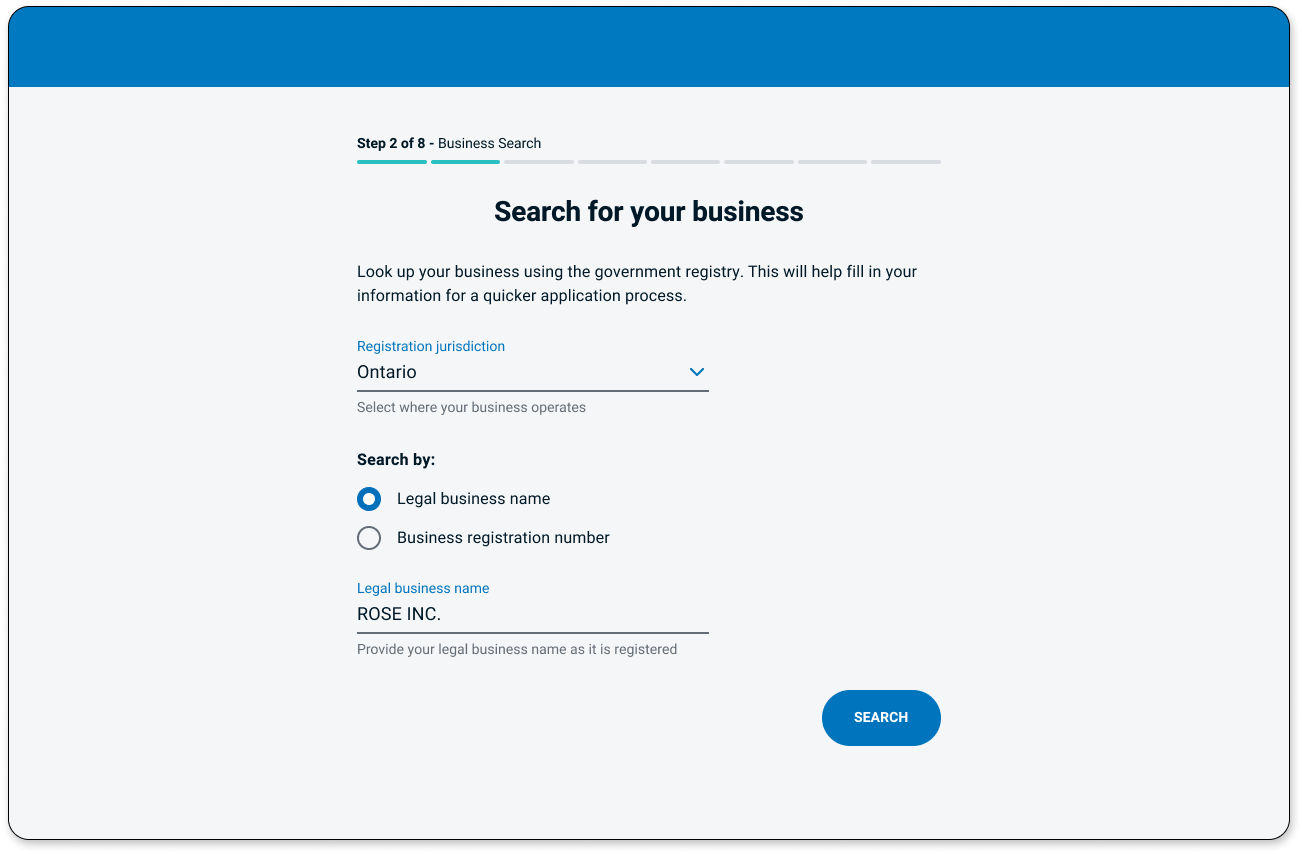

Connection with the government registry

We utilized APIs to link with government registries, enabling owners of incorporated businesses to search for their business. This integration allows for the direct retrieval of registration information from the source, ensuring data accuracy and saving users valuable time.

“I like it, I don’t need to step away to get my registration information”

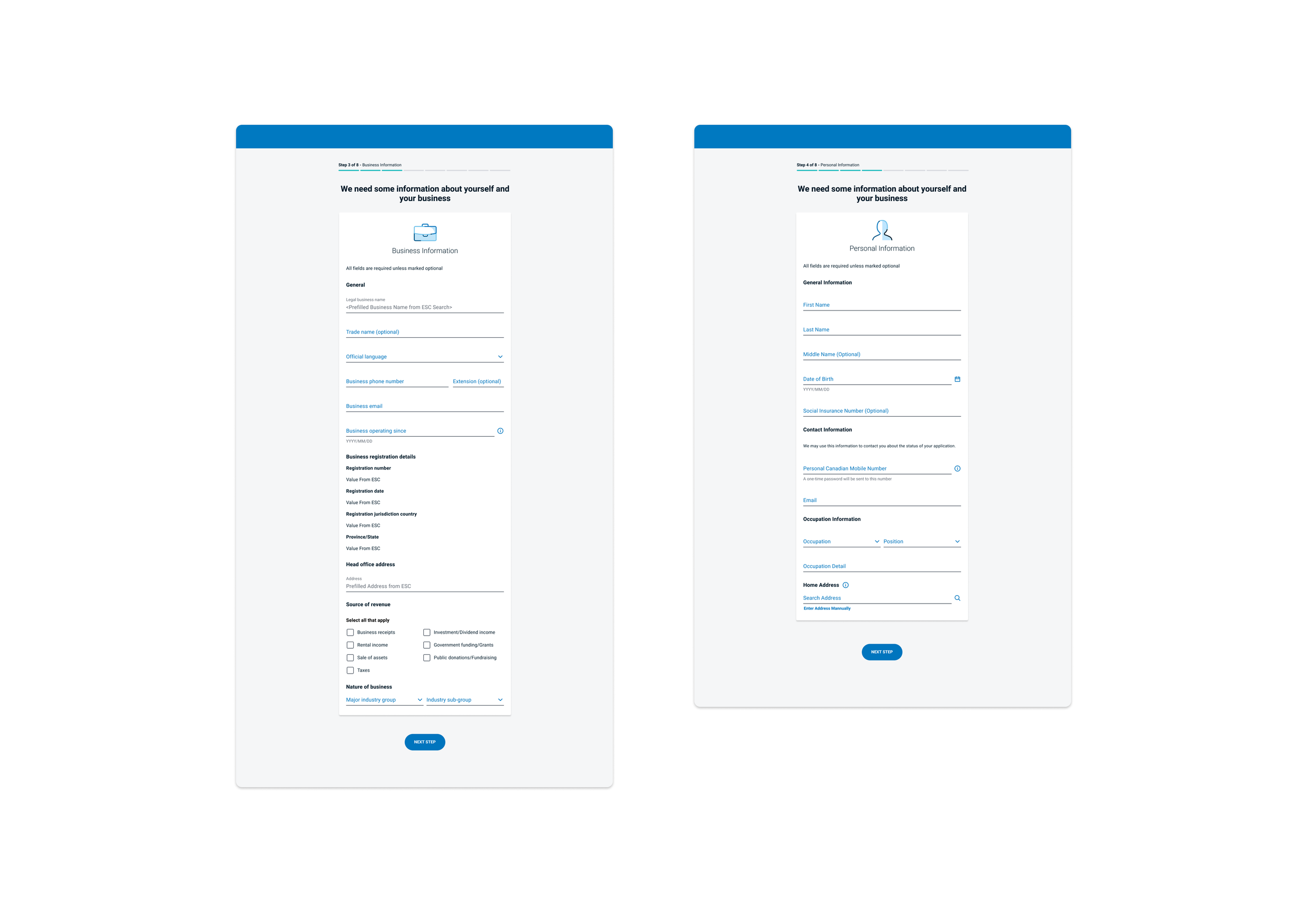

Segmenting the form into smaller, more navigable chunks

Our application prioritizes user experience by organizing input fields into coherent topics and breaking them down into manageable segments. By grouping related information together and presenting it in bite-sized pieces, users gain better context and experience reduced cognitive load during the application process. This thoughtful design approach not only increases the accuracy of user inputs but also enhances overall user experience by minimizing overwhelm and fostering clarity. With streamlined interactions, our application empowers users to navigate through the application seamlessly, ensuring a smoother and more intuitive experience.

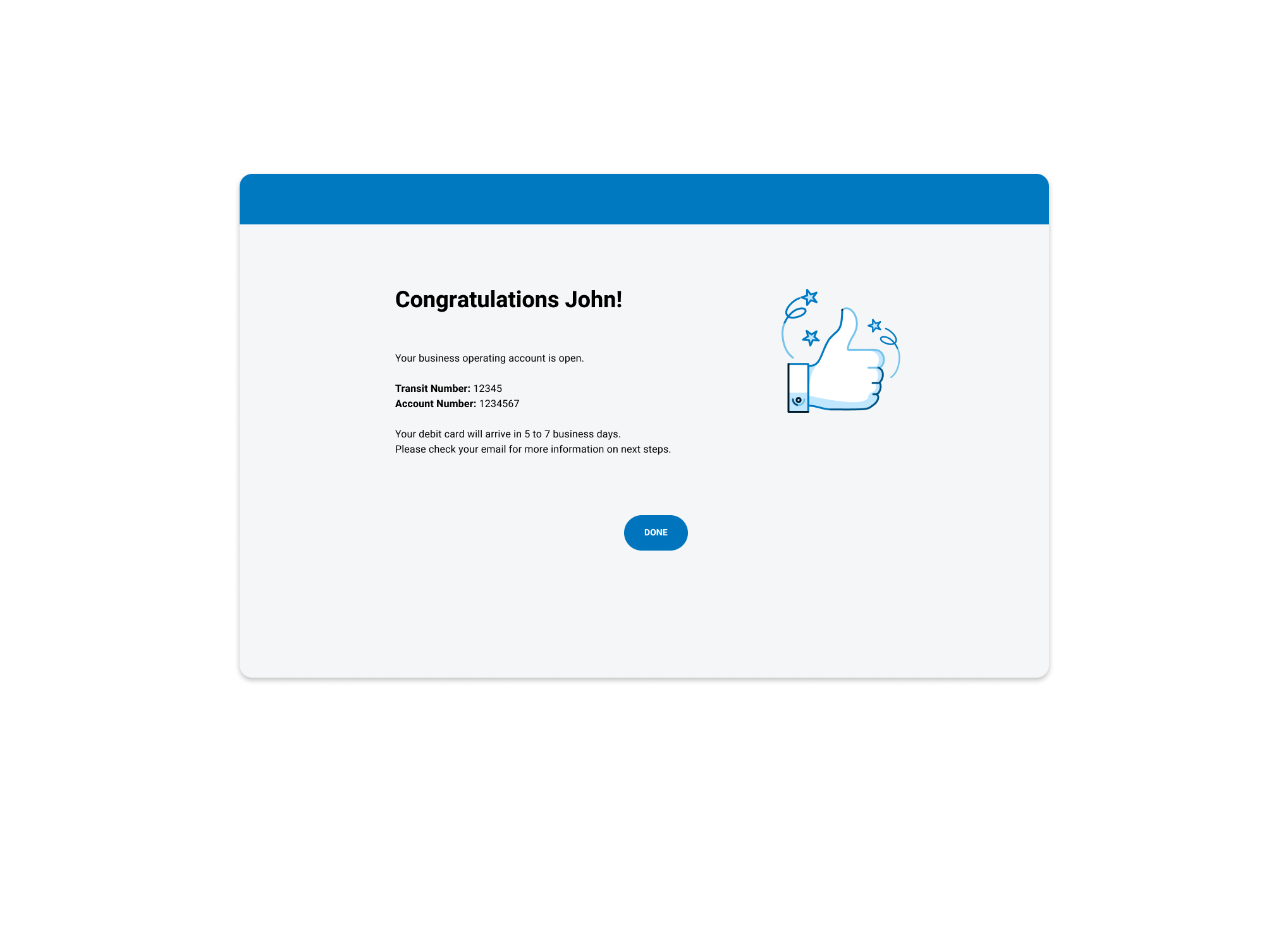

Post-Application Guidance: Essential Account Details and Next Steps

At the conclusion of the application process, we prioritize user convenience by furnishing clients with vital account information, including the transit number and account number. These crucial details are promptly provided to ensure a seamless transition into account usage. Additionally, our platform offers clear guidance on the next steps users should take, empowering them with actionable insights and facilitating a smooth onboarding experience. By equipping users with the essential information and direction they need, we aim to enhance satisfaction and confidence in their account setup journey.

Testing and findings

We conducted thorough user testing and feedback sessions with a diverse group of 8 participants, representing our two primary target user groups: sole proprietors and owners of single-owner corporations. This user-centric approach ensures that our platform is tailored to meet the distinct requirements of our diverse user base, ultimately enhancing the overall user experience and satisfaction.

Key Findings

Overall User Satisfaction:

All participants expressed high levels of satisfaction with the platform, citing its simplicity as a key factor.

Feedback consistently highlighted the intuitive design and straightforward navigation, contributing to a positive user experience.

Usability Issues:

Some participants reported confusion with certain banking terms used in the current design, indicating potential areas for improvement in clarity and terminology.

Anticipated usability issues related to the absence of a back button were noted during testing. Although participants did not initially notice this omission, upon further questioning, concerns arose regarding the potential impact on user experience, particularly when navigating between pages."

Tone and Voice:

Mixed feedback was received regarding the tone and voice used throughout the platform. While some participants appreciated the professional language, considering the context of business banking, others expressed a desire for a more personable tone. This highlights the importance of striking a balance between professionalism and approachability to cater to diverse user preferences and expectations."

Future Enhancement Recommendations:

Tone and Voice:

Consider incorporating a more personable tone in the platform's language while maintaining professionalism, catering to the preferences of a wider user base. This could involve using conversational language where appropriate and infusing elements of empathy and warmth in communication.

Usability Improvements:

Implement a back button feature to enhance navigational flexibility and address potential user frustrations. Given that the absence of a back button was due to technical constraints, prioritize resolving these limitations to provide users with a seamless way to backtrack and revisit previous pages, improving overall usability and user experience.

Terminology Clarity:

Review and refine banking terms used in the platform to ensure clarity and comprehension for all users. This may involve providing tooltips or contextual explanations for unfamiliar terms, enhancing user understanding and reducing confusion.

Mini Wizard Tool:

Explore the possibility of integrating a mini wizard tool to assist clients in identifying key information, such as their source of income and industry group. This tool can guide users through a series of questions or prompts to gather necessary details, streamlining the application process and enhancing user engagement.