Business Express -Profile Creation Experience

By spearheading the UX design process, I seamlessly integrated net new clients into the business banking ecosystem. Eliminating the need for profile creation on the legacy system, we streamlined onboarding from application to activation. This user-centric approach ensures intuitive and efficient interactions, empowering employees to efficiently onboard clients and foster lasting relationships with the bank.

Client

Canada Big 5 Bank

Role

UX Design Lead

Year

2020

Initiative Objectives

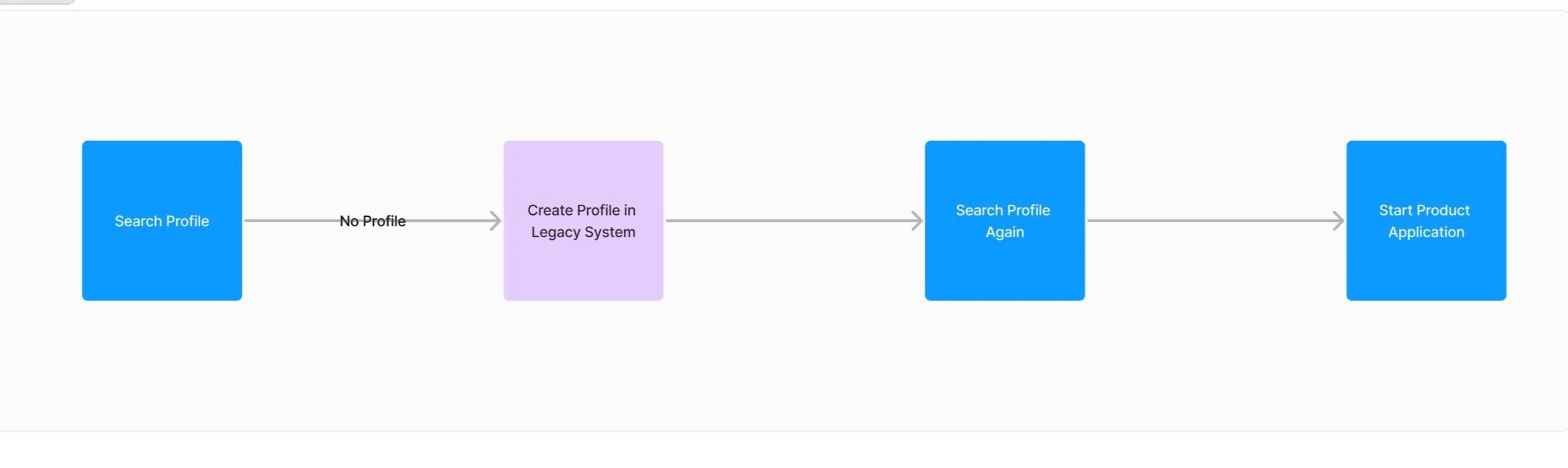

Before our initiative, creating a business profile in the legacy system proved to be counterintuitive and time-consuming, especially when bankers spent significant time on it in front of the client. This awkward and inefficient process not only hindered productivity but also resulted in a poor client experience. Frontline bankers, including relationship managers and branch bankers, faced significant challenges navigating through the cumbersome process. This often led to frustration and inefficiencies, hindering their ability to onboard clients effectively.

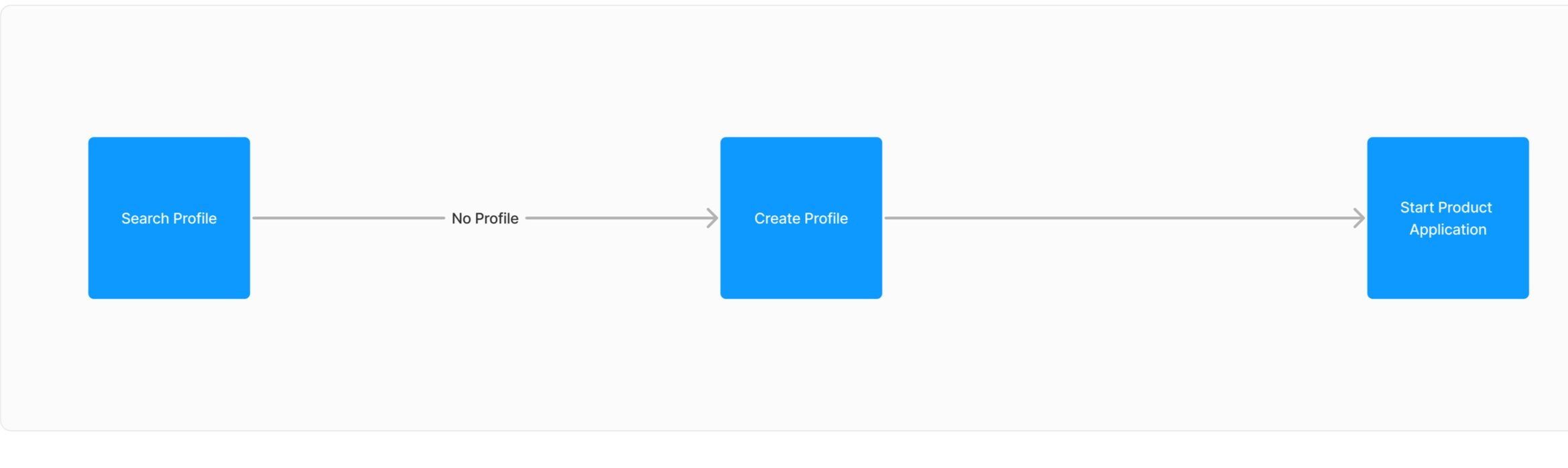

Recognizing these pain points, our objective became clear: to revolutionize the client onboarding experience by streamlining the process and eliminating unnecessary complexities. Through the implementation of Business Express, our aim is to empower frontline bankers with a user-friendly solution that facilitates seamless integration of net new business banking clients, ultimately improving efficiency and enhancing customer satisfaction.

Before

After

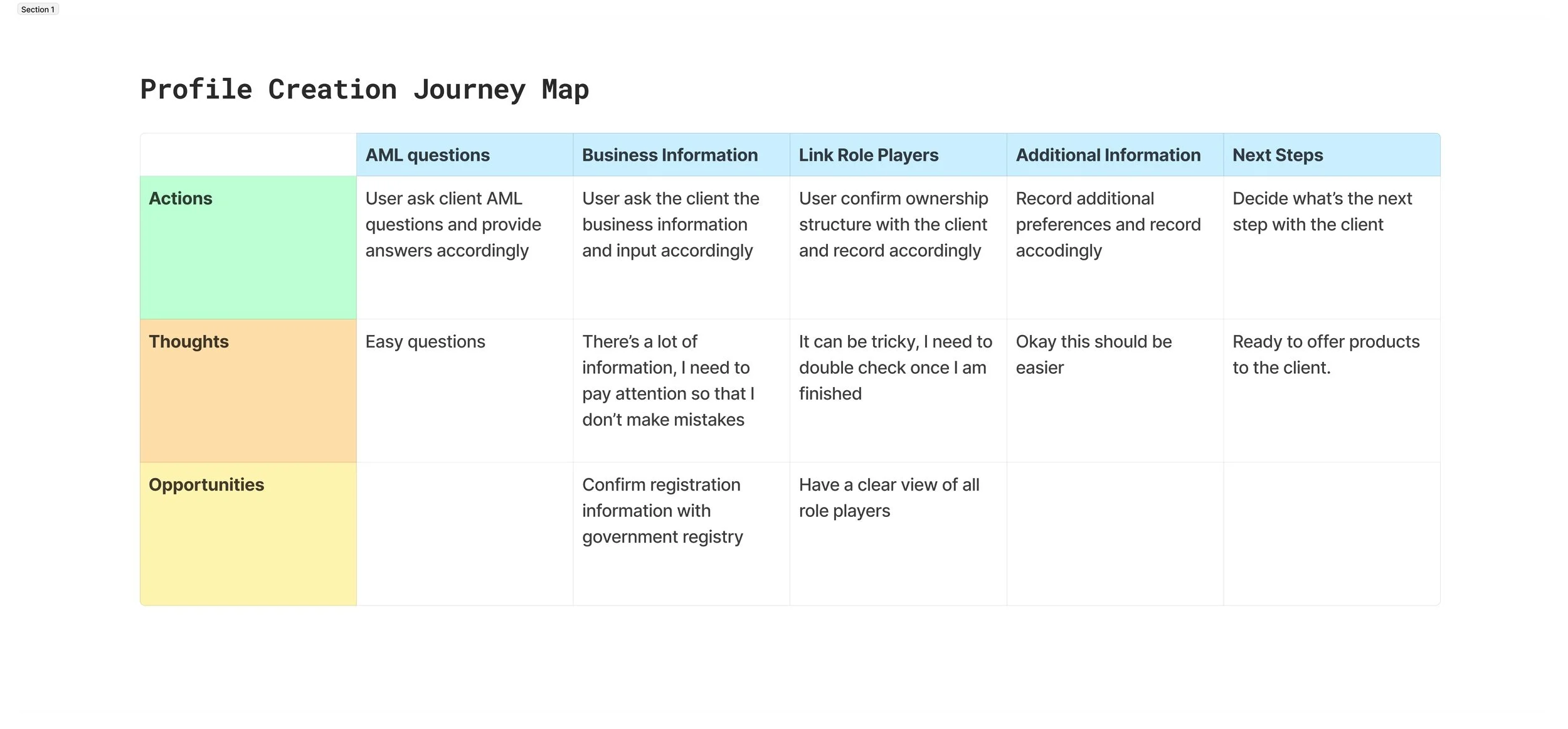

User Journey

In light of the extensive data input demanded by this process, we leveraged a user journey map to meticulously identify its core steps and main components. Through this methodical approach, we pinpointed key opportunities for optimization, including the integration of government registry connectivity via API. Additionally, we prioritized designing a comprehensive overview of business role players for user review, ensuring clarity and efficiency throughout the onboarding journey.

Design Highlights

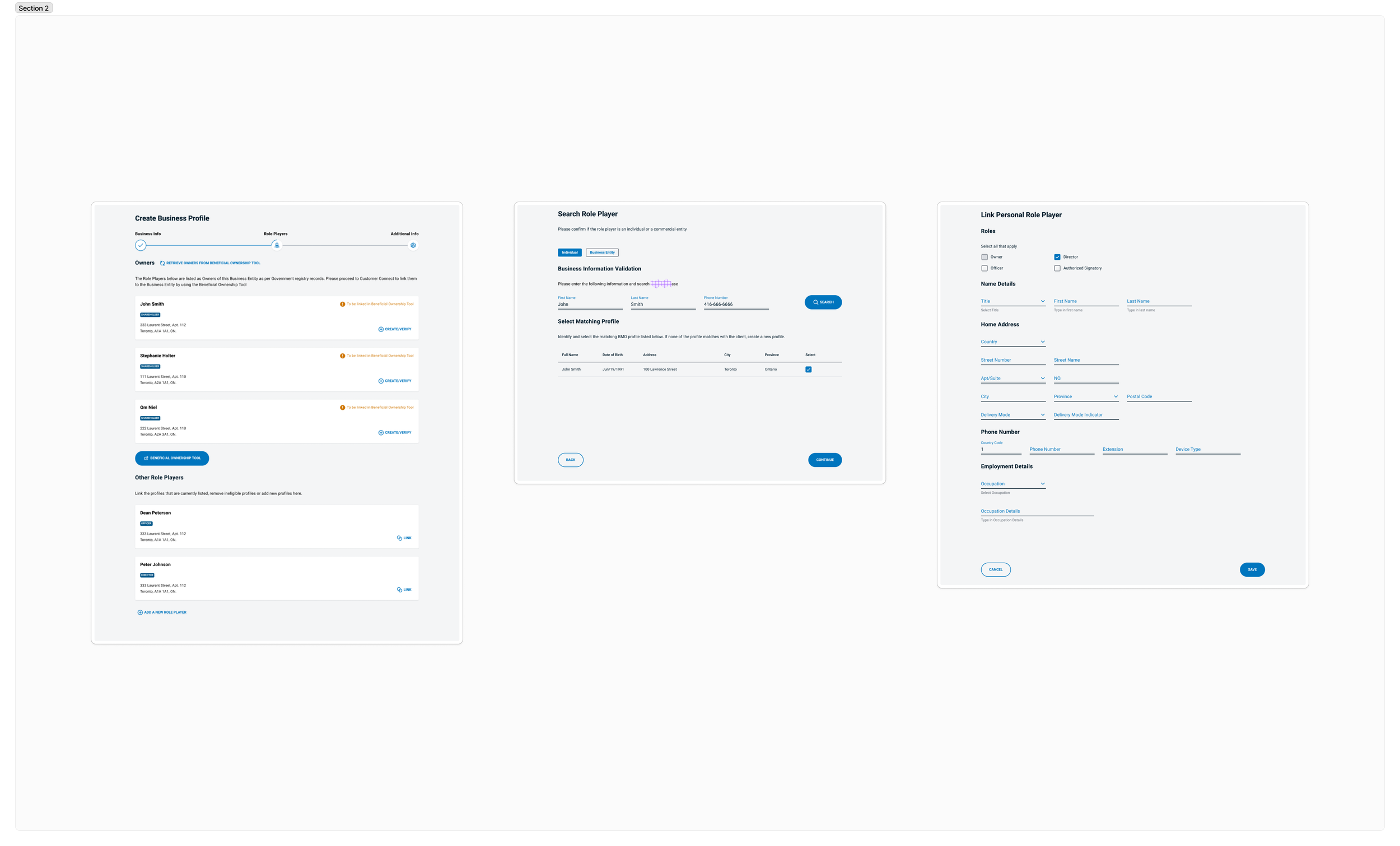

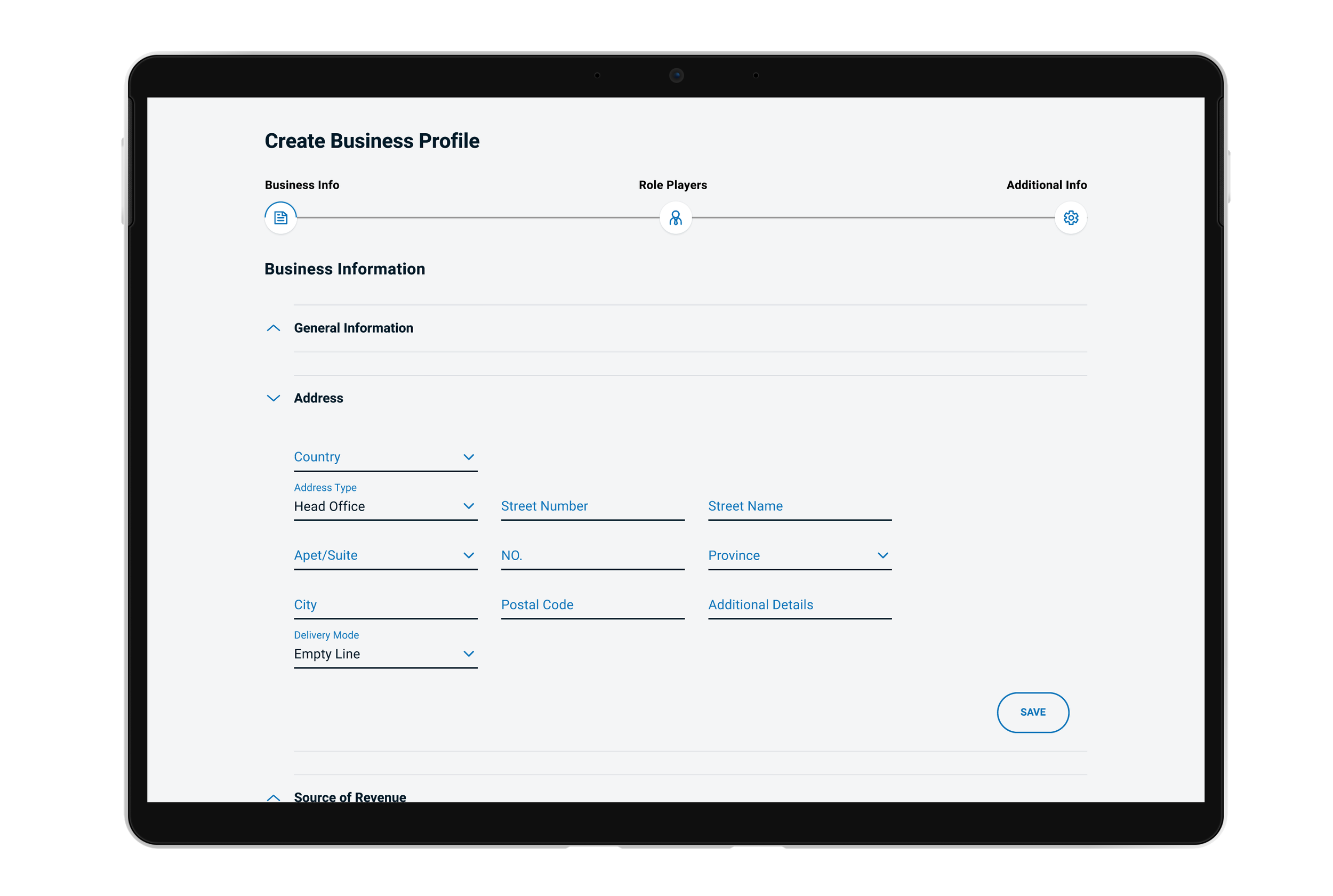

Segregation of Main Topics and Subtopics with Step-by-Step Input Style and Progress Indicator

I designed a structured approach by segregating main topics and subtopics. This organization allowed users to focus on specific areas of input, reducing cognitive overload and enhancing clarity.

Additionally, I introduced a step-by-step input style, guiding users through the process in a sequential manner. This approach not only minimized errors but also improved the overall user experience by simplifying complex tasks into manageable steps.

Company Role Players Tab for Enhanced Management and Editing

This feature provides users with a centralized hub where they can easily view, add, remove, and edit role players associated with the business file.

By presenting a comprehensive list of role players, users maintain a clear overview of all relevant stakeholders, ensuring accurate representation within the system. Additionally, intuitive editing functionalities are integrated directly into each role player's card, allowing users to swiftly update details with a simple click.

This streamlined approach enhances user efficiency and facilitates seamless management of role player information throughout the profile creation process.

User Control and Navigation

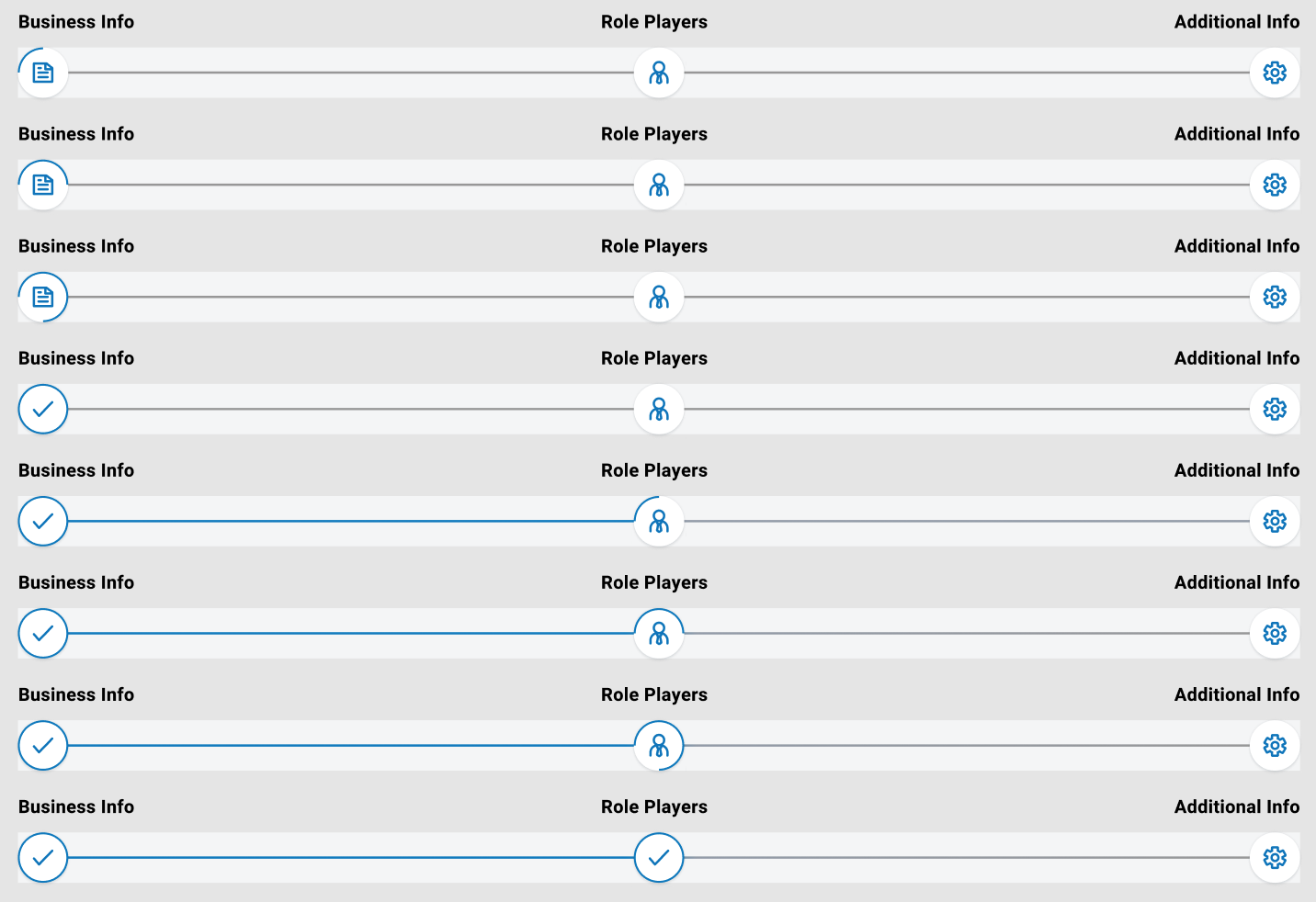

I designed a progress indicator to inform users, especially new users, about their current position in the process and what lies ahead, ensuring transparency and aiding navigation. This intuitive feature empowers users to track their progress throughout the profile creation journey, providing a sense of control and direction.

By visualizing the completion status of each step, users can anticipate upcoming tasks and plan accordingly, reducing uncertainty and enhancing confidence. This strategic addition not only streamlines the user experience but also fosters a greater sense of engagement and ownership over the process.

Impact

Improved Banker Efficiency:

The initiative has significantly boosted frontline banker efficiency by streamlining the client onboarding process. With the elimination of cumbersome profile creation steps, the average duration of profile creation time reduced by 50%, bankers can now onboard clients more swiftly and effectively, allowing them to focus on delivering superior service and building stronger client relationships.

Higher Quality of Client Profile Data:

By implementing a structured approach to profile creation and incorporating validation checks, the initiative has led to a marked improvement in the quality and accuracy of client profile data. With clearer input guidelines and reduced room for error, the system now ensures that client profiles are comprehensive and up-to-date, providing bankers with reliable information for informed decision-making and personalized service delivery.

More Streamlined Experience in Business Express:

The introduction of Business Express has revolutionized the client onboarding experience, offering users a more streamlined and user-friendly platform for accessing banking services. With enhanced navigation features, intuitive interface design, and seamless integration with external registries, clients can now navigate through Business Express with greater ease and efficiency, resulting in higher satisfaction and increased usage of the platform.